January 17, 2019

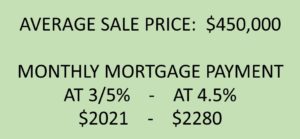

If you’re ready to buy a home affordability may be a concern but with the job market improvements a would-be homeowner has good reason to be confident. The slight increases in mortgage interest rates do affect the overall amount a buyer will qualify for, but those slight increases actually don’t add more than a few dollars to monthly payments.

Most people don’t know this, but January is one of the very best times for a home buyer to make their move! Any price reductions a seller has been contemplating have most likely been made which benefits the January buyer. You may experience a lower inventory to choose from, but this too is beneficial. Armed with a list of needs and wants, narrowing down the right house for you is easier without so many distracting choices to weed through.

You may, however, still want to take several days or so to prepare for a successful house hunt. That way when you walk into the perfect house of your dreams you can walk right on through to a successful closing!

CHECK CREDIT SCORES: put your finances in order so lender requirements can be met quickly and the approval process streamlined. Here’s what you are looking for:

- Correct any errors that you find! It’s true, the credit reporting agencies have been known to make mistakes. This could cost you in terms of interest rates or being eligible for a mortgage at all, so take care of these fixes first.

- Clear up any outstanding debts. You might be surprised to discover that last loan payment left a tiny balance and it sits there on your credit report, miniscule but looking suspiciously like a failure to pay.

- Don’t close any credit cards. Even if you aren’t using them anymore it actually hurts your credit score to close those accounts. Wait until after you talk to your lender to make any changes other than paying off small balances, clearing up any outstanding debt and correcting any errors.

SHORE UP CASH RESERVES: this is definitely not the time to take on any new debt or splurge on any big purchases. Even if you’ve qualified for a zero down loan package, having cash reserves is necessary for Out of Pocket expenses like:

- Home Inspection

- Loan application fees

- Closing costs

- Moving costs including utility deposits, movers, or other unexpected expenses

Like most people, buying a home is most likely the single largest financial investment you will make. Your local marketing specialist can offer guidance and assistance in this process, to make things go smoothly in your next home purchase.

Recent Comments